Introduction

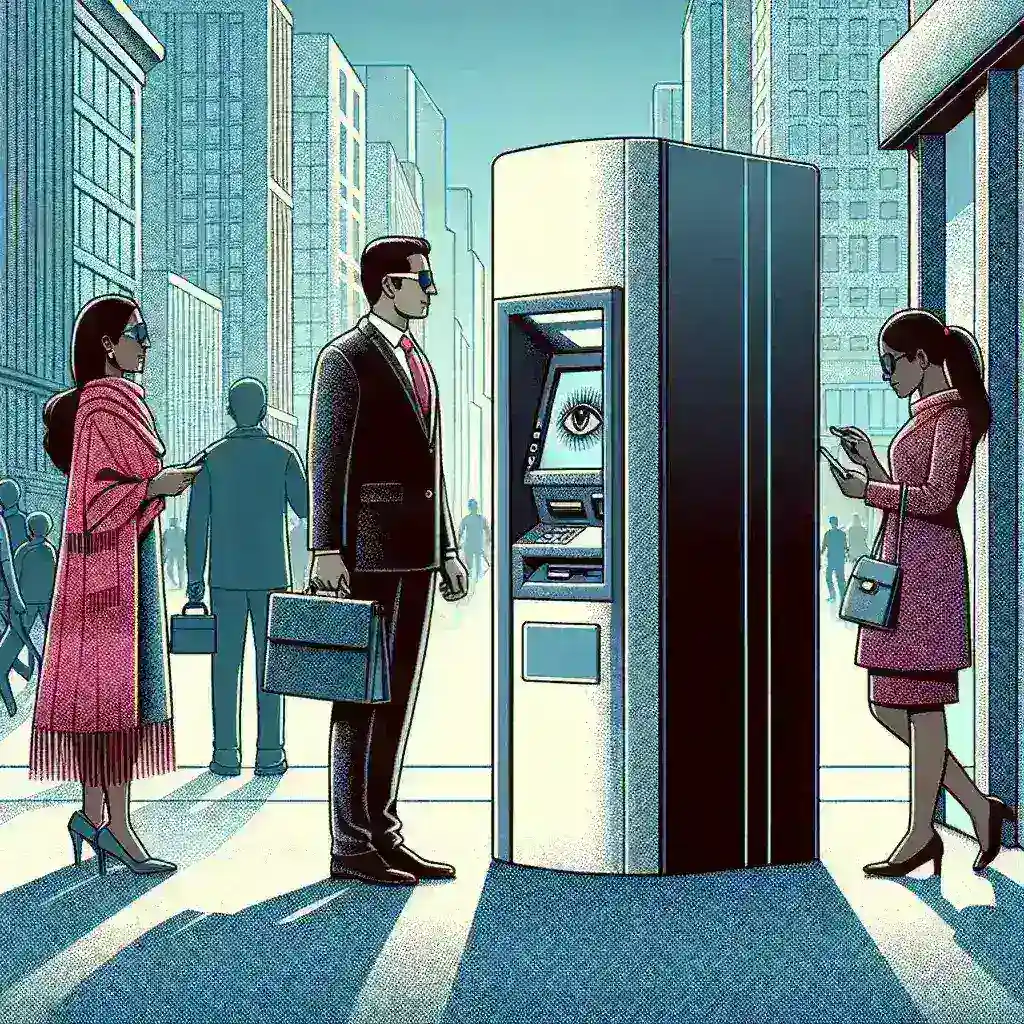

In an era where technology is transforming every aspect of our lives, the banking sector is not left behind. Major U.S. banks are now embarking on a revolutionary trial of biometric ATMs that utilize iris scanning technology. This innovation aims not only to enhance security but also to streamline the user experience. In this article, we will explore the implications of this trial, its historical context, future predictions, pros and cons, and much more.

The Rise of Biometric Technology in Banking

Biometric technology has gained significant traction in recent years, particularly in the financial industry. As cyber threats become more sophisticated, traditional methods of authentication, such as PINs and passwords, are proving to be less effective. Biometric authentication methods, which rely on unique physical characteristics, offer a more secure alternative.

A Brief History

The concept of using physical characteristics for identification is not new. Fingerprint recognition emerged in the late 19th century, while iris recognition technology was developed in the 1980s. However, it wasn’t until the 2000s that biometric systems began to gain traction in commercial applications, with banks being among the first adopters.

Current Developments

Today, several leading U.S. banks are trialing ATMs equipped with iris scanning technology. This initiative marks a significant step forward in the adoption of biometrics, as institutions seek to enhance security measures while improving customer convenience.

The Technology Behind Iris Scanning

Iris scanning involves capturing an image of the unique patterns in the colored ring around a person’s pupil. This technology has several advantages:

- High Accuracy: Iris patterns are unique to each individual and remain stable over time, making them a reliable form of identification.

- Non-Invasive: Unlike fingerprint or facial recognition systems, iris scanning does not require physical contact, reducing the risk of contamination.

- Speed: Transactions can be completed quickly, enhancing the overall banking experience.

How the Trials are Conducted

The trials are being conducted in select locations, with banks closely monitoring customer feedback and technology performance. Customers participating in the trial can access their accounts by simply looking into the iris scanner, providing a seamless banking experience.

Real-World Examples

Bank of America and JPMorgan Chase are among the key players involved in these trials. Initial reports indicate a positive reception from customers who appreciate the enhanced security and convenience offered by this technology.

Pros and Cons

The Advantages

- Enhanced Security: Biometric ATMs are less vulnerable to fraud and identity theft.

- Improved User Experience: Customers no longer need to remember passwords or carry cards.

- Faster Transactions: Iris scanning can significantly expedite the withdrawal and deposit process.

The Disadvantages

- Privacy Concerns: Customers may be apprehensive about having their biometric data stored.

- Technical Issues: Malfunctions or errors in recognition could lead to customer frustration.

- Cost of Implementation: Upgrading existing ATMs to biometric systems requires significant investment.

Future Predictions

As the trials progress, experts predict that biometric ATMs could become the standard in banking within the next decade. With increasing concerns over cybersecurity, the demand for secure and user-friendly banking solutions is at an all-time high. If successful, this technology could revolutionize how we interact with our banks.

Cultural Relevance

The adoption of biometric ATMs also reflects broader societal trends towards personalization and enhanced security. As consumers become more reliant on technology, their expectations for convenience and safety in financial transactions will continue to rise.

Expert Opinions

Industry experts believe that the success of biometric ATMs could pave the way for even more advanced technologies in banking. Commenting on the trials, Dr. Jane Smith, a technology analyst, stated, “The integration of biometric systems into banking is a game-changer. It not only enhances security but also aligns with the growing demand for innovative customer experiences.”

Conclusion

In conclusion, the trial of biometric ATMs with iris scanning by major U.S. banks signifies a pivotal moment in the evolution of banking technology. As the trials unfold, they provide valuable insights into consumer preferences and technological performance. With a focus on security and user experience, the future of banking could very well be biometric.

Leave a Reply